Managing business payments effectively is a key component of smooth financial operations. NetSuite offers a robust system for writing, printing, and voiding checks. In this blog, we’ll guide you through how to manage checks in NetSuite with ease and accuracy.

How to write a check in NetSuite?

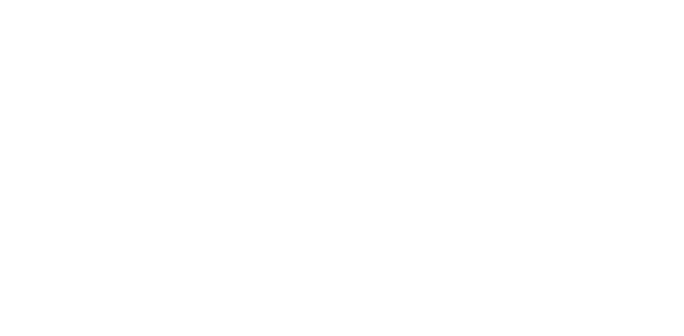

The check function in NetSuite can be used in several ways. You can use it to pay for expenses, record non-check transactions, record cash transactions, or enter non-check debits, such as debit card transactions. Saving a check transaction records the expense directly into the company’s books by debiting the expense account specified in the transaction detail and crediting the bank account selected for the check.

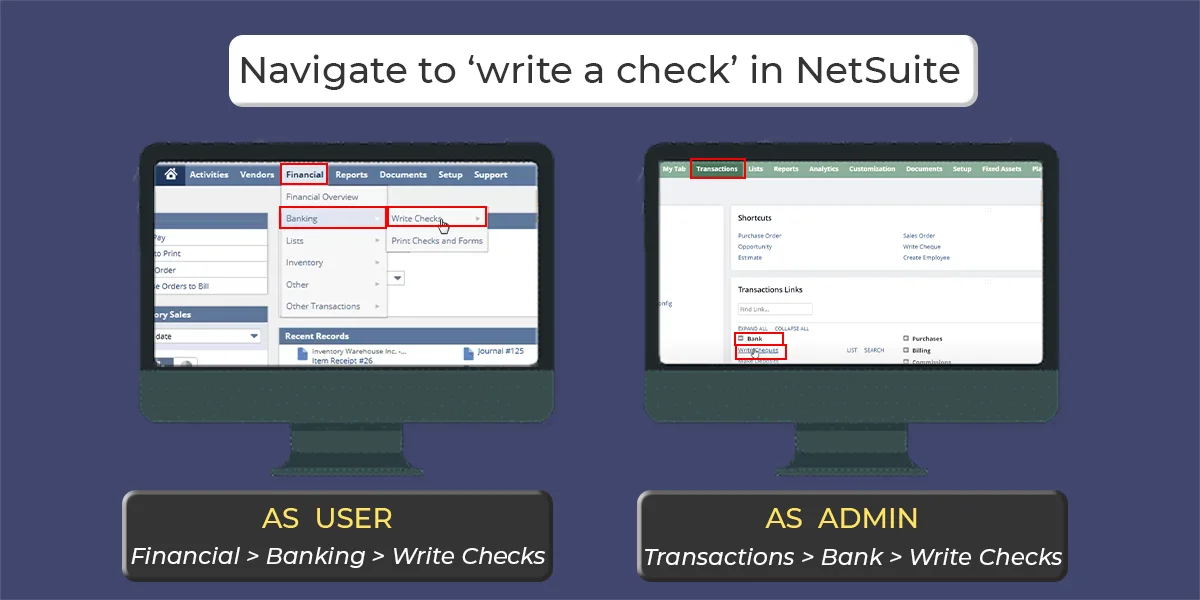

Navigate to Financials, Banking, and Write Checks. If logged in as an administrator, you can click on a different path: transactions, bank, or write checks. Both navigation paths will bring you to the right check page in NetSuite.

It is good practice to ensure that the mailing address matches the one on file. By selecting the To Be Printed checkbox, you can choose to print this check or not.

Once a check has been created, it is to be accessible in the reminder’s portlet for checks of printing. During this time, the check can also be voided or reversed.

You can contact the GIR team for further assistance for more information in writing checks.

How to print a check in NetSuite?

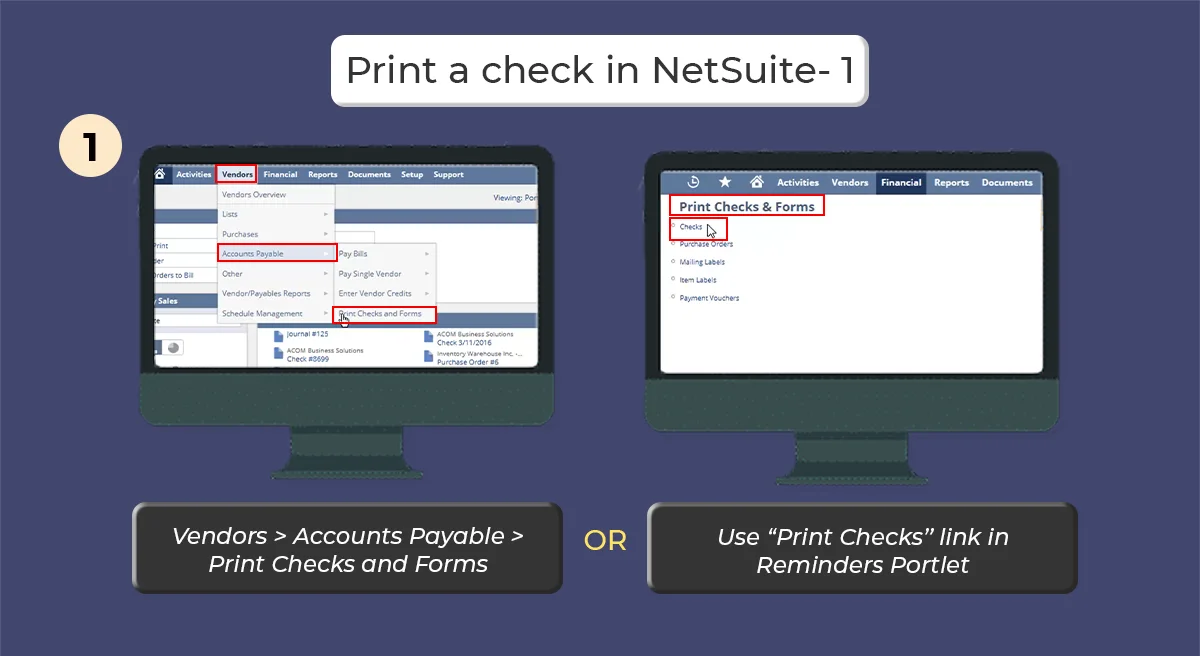

NetSuite’s cloud-based environment lets you print checks and forms. Navigate to Vendors, Accounts Payable, and then Print Checks and Forms.

Alternatively, you can select the checks to print link in the reminders portlet if it’s configured.

Please note that almost all of these forms require Adobe Reader as a plug-in to view their print previews.

When you click the first link here, checks, the Print Checks page opens. In the account dropdown field, select the proper account associated with the check you need to print.

The check forms can be customized if needed. The customization feature can be accessed in Setup, Customization, Forms, and Transaction Forms.

Select all different checks and then click Print to print checks.

How to void a check in NetSuite?

A Voided check is a check that has been canceled. Once voided, a check cannot be reused. There are several possible reasons for voiding a check.

The check may have been filled out incorrectly, the payment transaction may have been canceled, or the vendor may have informed the payer that the check had never been received.

Voiding checks in NetSuite creates a reversal journal entry in the general ledger. This means that if you void a check payment for a vendor bill, the payment for that transaction will be invalidated. This action will also return the vendor bill to the status of open and list it again as a bill to pay.

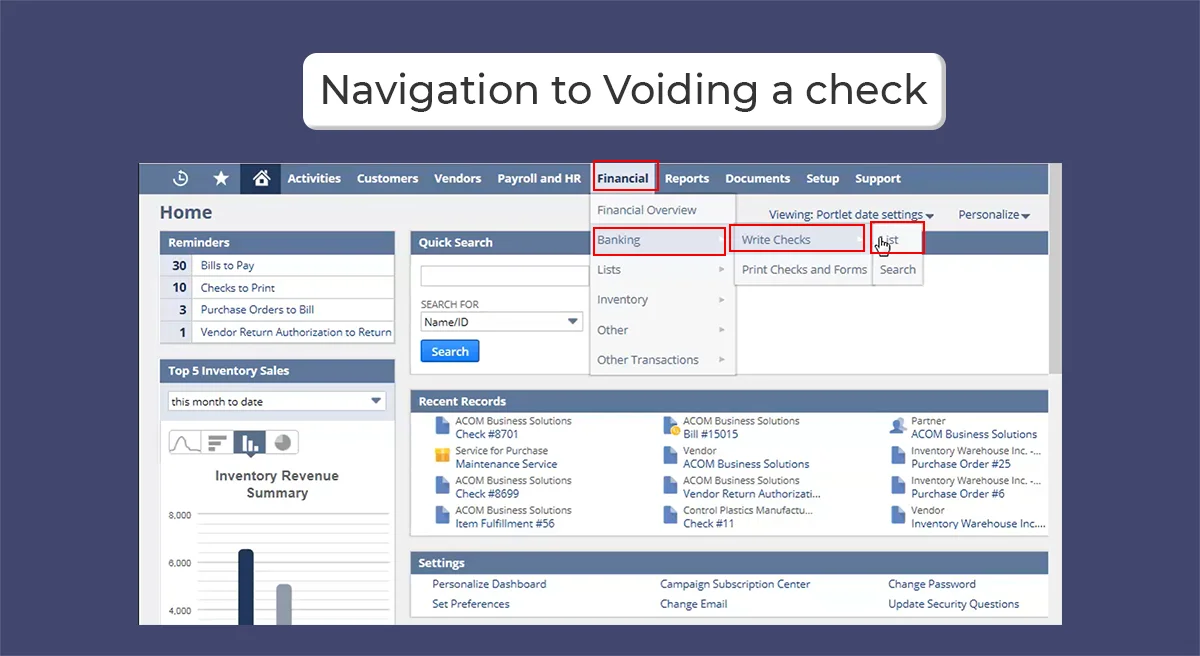

You can navigate to Financial, Banking, Write Checks, and select List to display a list of all the available check transactions. Alternatively, you can enter the exact check number in the global search field if you have that information. Enter the prefix key followed by the check number.

Before voiding the check, please review the registers that will be affected. To do that, you’ll click Action and then select GL Impact. Here, you can see the accounts that would be affected by voiding this transaction. Since no change is required, you’ll just click on the Void button to proceed. You will be taken to the voiding journal page, where the voiding journal entry is created. You can review the check details and then click on the Save button to commit this transaction. It’s important to note that to avoid checks that affect inventory and adjust inventory, a form must be completed to enable the voiding process to continue. Otherwise, an error message will display and prompt you to do so.

Conclusion:

NetSuite makes managing checks easy and accurate, from writing and printing to voiding with full audit trails. It helps businesses stay on top of payments and financial records. GIR Software Services can assist you in setting up and optimizing NetSuite’s check management to fit your needs.

Contact us to simplify your financial processes and learn more about writing, printing, and voiding checks.