Running a business is like going on a road trip – you plan your route, pack your products, and get ready to sell online or in stores. But just like every trip has toll roads, your business has something called sales tax – a fee you collect from customers and send to the government.

Sales tax helps fund things like roads, schools, and public services. It’s important to know when, where, and how much to charge. The rules change depending on where your customers live and where your business operates. Luckily, there’s a great travel buddy to help with this: NetSuite SuiteTax.

At GIR Software Services, we help businesses use SuiteTax the right way – so taxes are one less thing to worry about on your journey.

Different Roads, Different Rules

As you travel through different places, you’ll run into different kinds of taxes:

● Sales Tax (U.S)

● GST (Canada, India)

● VAT (Europe)

Each area (called a tax jurisdiction) has its own tax rules. For example, in the U.S., tax can be different from state to state – and even from city to city. Whether you’re selling on Amazon, your own website, or through B2B channels, you need to make sure you’re charging the correct amount.

Meet Your Travel Vehicle: NetSuite SuiteTax

SuiteTax is a tool inside NetSuite that figures out the right tax to charge. It uses your warehouse location and your customer’s shipping address to calculate tax automatically.

Each area your business operates in is called a nexus. That just means a place where you have to follow local tax rules. Some businesses have more than one nexus. With SuiteTax, you can keep track of them all – no matter where your customers are.

Take a Break at These Non-Tax Stops

Not everything gets taxed. Here are a few “rest stops” where taxes don’t apply:

● Tax Holidays: Some states have special weekends with no sales tax.

● Non-Taxable Items: Like groceries or medical items that are tax-free.

● Tax Exemptions: Some customers (like nonprofits) don’t have to pay tax. They just need to provide their certificate.

SuiteTax lets you handle all of this easily.

Why SuiteTax Makes the Trip Easier

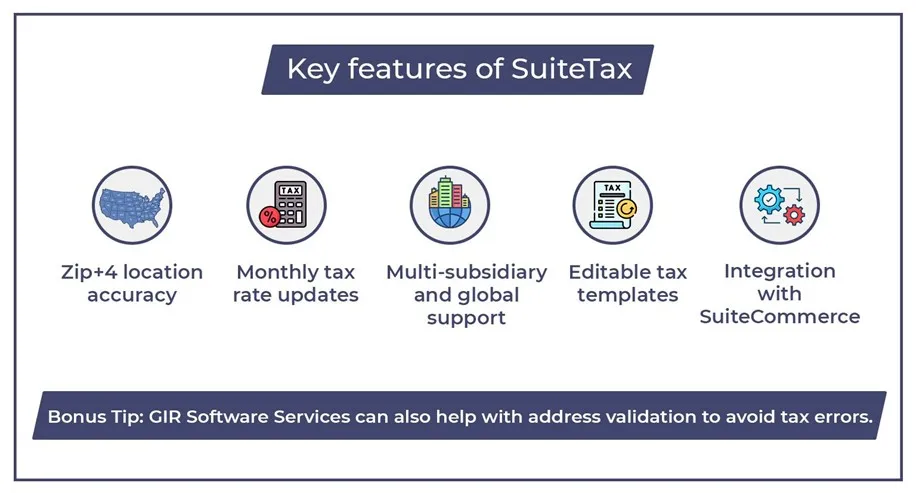

SuiteTax comes with helpful tools to keep your business running smoothly.

● Calculates tax using Zip+4 address (very accurate!)

● Updates tax rates automatically every month

● Works in over 100 countries

● Lets you edit and customize tax reports

● Handles multiple tax rules for different business locations

● Works with SuiteCommerce and other NetSuite tools

Bonus Tip: At GIR, we can help you double-check customer addresses using Google to make sure the right tax gets charged – no surprises!

Why Businesses Love SuiteTax

Here’s what SuiteTax helps you do:

● Save time and avoid mistakes with automatic tax calculations

● Work with many countries at once

● Update tax rates based on dates (great for historical orders)

● Cut down on extra API calls with “Tax Details Override”

● Customize your invoices and PDFs

● Use it with both older and newer versions of SuiteCommerce

Let GIR Be Your Tax Travel Guide

Think of us as your road trip co-pilot. Here’s how we can help:

● Save money if you’re using an expensive third-party tax tool

● Switch from older tax systems to SuiteTax the right way

● Handle many locations (subsidiaries) with just one solution

● Test everything in a sandbox before going live

● Check for custom needs and special rules based on your industry

Ready to Hit the Road with SuiteTax?

Taxes don’t have to slow down your business. Whether you’re just getting started or ready for an upgrade, the GIR Software Services team is here to help you stay on the right path.

Contact Us Today to learn how SuiteTax can save money, avoid mistakes, and make sales tax one less thing to worry about on your business journey.